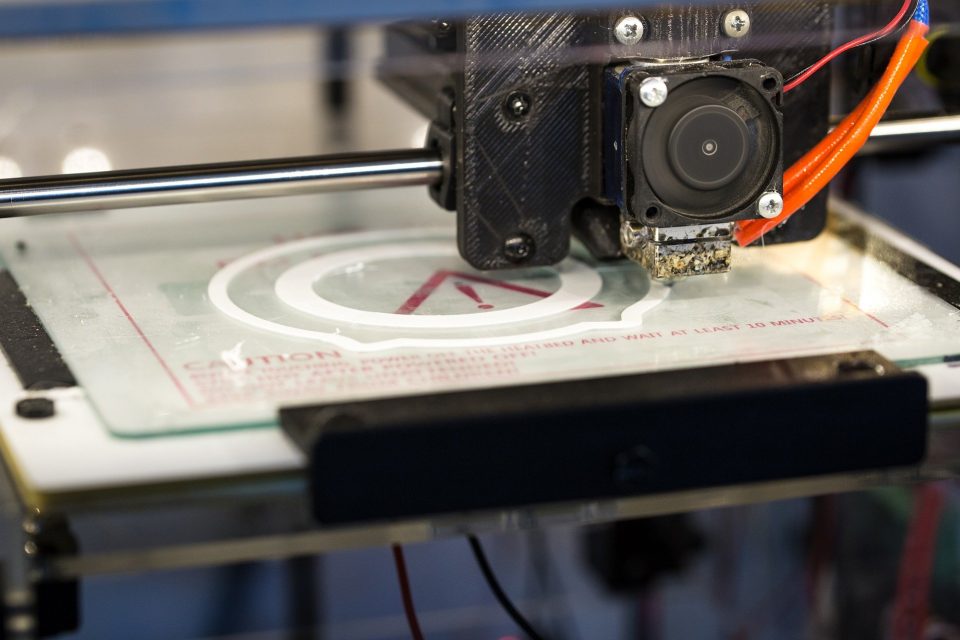

Derby among top 15 European centres for 3D printing

A new study from the European Patent Office (EPO) reveals the United Kingdom as a leading European country in additive manufacturing (AM) innovation, also known as 3D printing.

• UK is second largest European contributor to additive manufacturing (AM) innovation behind Germany

• Derby among top 15 European innovation centres for AM technologies • Patent applications at the EPO related to AM are rising rapidly, achieving average annual growth of 36% in recent years

• Europe is a global leader with European inventors and businesses accounting for almost half of AM patent applications filed with the EPO in the last decade

• Impact of AM spans many industries, with the health sector generating most patent applications Munich, 13 July 2020

The United Kingdom accounts for 5% of AM patent applications at the European Patent Office (EPO), putting it in second place behind Germany with 19%. European patent applications for AM increased at an average annual rate of 36% from 2015 to 2018. This is more than ten times greater than the average yearly growth of all applications at the Office combined in the same period (3.5%).

The report, entitled “Patents and additive manufacturing – Trends in 3D printing technologies”, further demonstrates that Europe is a global leader in AM, with European inventors and businesses accounting for almost half of AM patent applications filed with the EPO in the period from 2010 to 2018.

“The surge in additive manufacturing is part of the broader, rapid rise of digital technologies overall, confirming that the digital transformation of the economy is fully reflected in patent applications reaching the EPO,” said EPO President António Campinos.

“Europe has become a global hub for innovation in fast-growing digital fields, including additive manufacturing technologies. This strength is clearly reflected in the list of top AM applicants, with European inventors and businesses submitting almost half of the patent applications in the past decade.”

The report shows that European countries account for 47% (or 7 863) of all AM inventions for which patent applications were filed at the EPO in the period from 2010 to 2018. Europe’s leading position is largely attributable to Germany’s performance, with the country generating 19% (or 3 155) of all patent applications in AM, followed by the United Kingdom with 5% (833 patent applications), which exceeds its share in patenting in all technologies at the EPO. At numbers three to five, France, the Netherlands and Switzerland exhibit similar contributions of around 4%.

The United Kingdom shows a high degree of specialisation in AM patenting with an RTA (revealed technological advantage) index of 1.2, which is one of the highest of all European countries, particularly in the digital aspects of AM and in AM application domains. The data also shows that Derby is at number seven in a ranking of 15 major European AM innovation centres and by far the most important British region.

Biggest sectors for AM patent applications are health, energy and transportation The study’s data further indicate that the impact of AM technologies spans a large variety of industries. Since 2010 the use of AM in the health sector has generated the greatest demand for patents (4 018 applications), followed by energy and transportation, both filing significant patent application volumes (2 001 and 961 applications respectively). Rapid growth was also observed in areas such as industrial tooling, electronics, construction and consumer goods, and the food sector. (Fig.: AM applications at the EPO by application domain, 2010-2018) Applicants from all industries – Rolls-Royce third largest European filer This diversity of sectors is also reflected in the profile of the top applicants at the EPO.

The analysis shows that the top 25 applicants accounted for about 30% (or 6 548) of all AM patent applications filed between 2000 and 2018. Led by large US firms General Electric and United Technologies, with Europe’s Siemens in third place, the list is comprised of a highly diverse range of players from many different technology fields such as transportation, chemicals and pharmaceuticals, information technology, electronics, imaging and consumer goods, as well as pure 3D-printing specialists such as Stratasys, 3D Systems and EOS. Rolls-Royce, with 248 EP applications, is at number seven and the third largest company if only European companies are considered, followed by Renishaw and BAE as the second and third biggest UK applicants. The US and Europe also dominate the ranking overall, with 11 US and eight European companies among the top 25 applicants. Significant contribution from smaller players.

While two out of three patent applications in AM technologies were filed by very large companies, the study also reveals that companies with 15 to 1 000 employees accounted for 10% (or 2 148) of applications, individual inventors and small businesses with fewer than 15 employees generated 12% (or 2 584), and were responsible for over 11% (or 2 448), making these three cohorts significant actors in the AM innovation ecosystem.

These findings are reflected in the figures for the United Kingdom where very large companies account for 63% of patent applications in AM technologies, followed by inventors and small businesses of up to 15 employees and universities, hospitals and public research organisations with both 14% and companies of up to 1 000 with 8%. British SMEs with notable activity in AM innovation are, among others, Embody Orthopaedic, a University College London spin-out, Fuel 3D technologies and Metalysis.