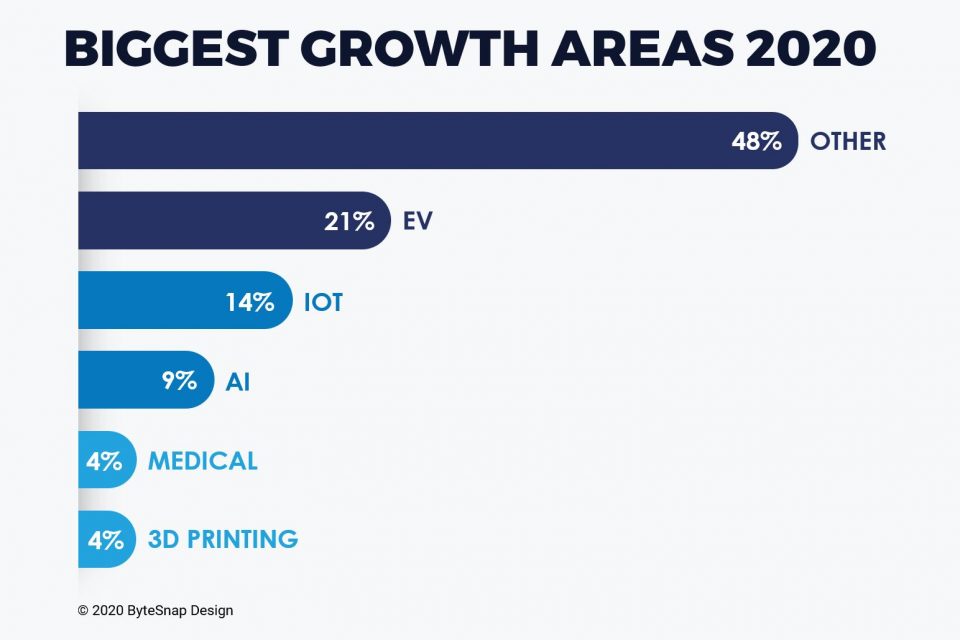

ByteSnap survey reveals the biggest growth areas in the UK electronics sector

Embedded electronics consultancy ByteSnap Design surveyed visitors at Southern Electronics to reveal that EV and IoT are the biggest growth areas for the UK electronics sector.

The largest single result was electric vehicle (EV) related growth at 21%, followed by Internet of Things (IoT) at 14%. A further 9% of companies expected growth to come from AI and 4% from the 3D printing and medical sectors. The other 48% of companies surveyed underlined the diverse spectrum of industries the electronics sector touches from cleantech to oceanography.

Just recently, it was announced that the ban on selling new petrol, diesel or hybrid cars in the UK will be brought forward from 2040 to 2035 at the latest, under government plans. The change comes after experts said 2040 would be too late if the UK wants to achieve its target of emitting virtually zero carbon by 2050. This fact is driving EV market growth – from vehicles to charging infrastructure, the opportunities are immense.

The interest in IoT is understandable with the number of IoT connections in 12 key growth sectors, including consumer electronics, smart cities and intelligent buildings, predicted to grow from around 13 million in 2016 to over 150 million by 2024 in the UK.

The survey says…we must design with longevity in mind

ByteSnap asked delegates about product longevity in the UK electronics. We learned that many of respondents are bucking a perceived short electronics lifecycle trend. Our survey revealed how our industry produces high-value electronics with long product life cycles. Therefore, it’s vital that we design with longevity in mind to maximise a potentially more profitable niche we have worked hard to create.

In regard to electronic product lifecycle longevity the results were notable. Only 16% of companies surveyed reported their product lifecycles were 2 years or less, 4% reported lifecycles of 2-5 years, and 14% lifecycles of over 5 years. The most interesting results were that 10% gave their product lifecycles as 5-10 years, 45% as over 10 years. These figures were marked considering the pace of technological innovation electronics design companies must adapt to, and the ongoing issue of obsolescence.

The results of our survey indicate that UK electronics companies appear less challenged by shorter electronics lifecycles. Perhaps many are already designing with longevity in mind, but this should certainly be a continuous process.

In a previous study we discovered that 18% of electronics industry respondents identified the pressure to deliver projects quickly as a major concern. And 17% were concerned about component obsolescence, a factor that can render an entire product difficult to sell and decimate the return on investment of developing a new product. We look more at strategies to combat obsolescence here but as part of designing for longevity, designers must closely scrutinise the lifecycle of component parts to make sure they too will be available long-term.

Of course, one of the greatest challenges for creating sustainable products is the pace of technological innovation. Therefore, designers must be ahead of the curve in understanding new technologies like EV development, IoT and AI and how these emerging technologies will change the products of the future, as well as when. Our top tips for designing for longevity include:

- use vendors like NXP and ST that publish longevity plans

- design using generic parts that have second sources

- avoid esoteric technology

- avoid components designed for the high-volume consumer market, as that market is very fickle as are the companies that supply into it.

These rules apply not only to silicon devices but as much to connectors and passives. The smallest component can cause an entire board to go obsolete and need a redesign. For markets like medtech, this can then involve expensive recertification.

To ensure products or components can continue to achieve that high-quality ten year plus lifecycle designers may need to consider the concept of backward compatibility. This is where regression testing heavily comes into play. When products are updated with new technologies , it is essential to determine whether a new component can be smoothly integrated and functions without negatively affecting the device. Another similar concept is that of refurbishment and whether a product be designed with upcoming component obsolescence planned in, and in a way that the obsolete part can simply be removed and replaced with the new innovation. For instance LCDs have very short lifecycles, so if possible boards should be designed to make switching LCDs easy in the future without complete redesign.

Many respondents were still heavily involved with analogue design and whilst this area has not seen the levels of transformation the digital component sector has over the last few decades, there are still many exciting new innovations being released that are bringing new life to this sector.

What is certain, is that if we continue to produce electronics products and components with longer life cycles in the UK, we steal a march on the global industry. We can take advantage of the benefits of these longer product life cycles including a reputation for high-quality manufacture and greater profit margins. Therefore, much consideration must be invested into designing for longevity.

Further Reading:

[1] https://www.designnews.com/content/long-lived-electronics-requires-careful-design/2012293459562/page/0/1

[2] https://bigbangip.com/design-for-longevity/

The post Survey: Biggest Growth Areas for UK Electronics Sector appeared first on ByteSnap Design.