Belfast, Glasgow, and Birmingham spearhead accelerated VC investment growth

According to new data, Belfast, Glasgow, and Birmingham have emerged as the fastest-growing startup ecosystems for venture capital investment in the UK.

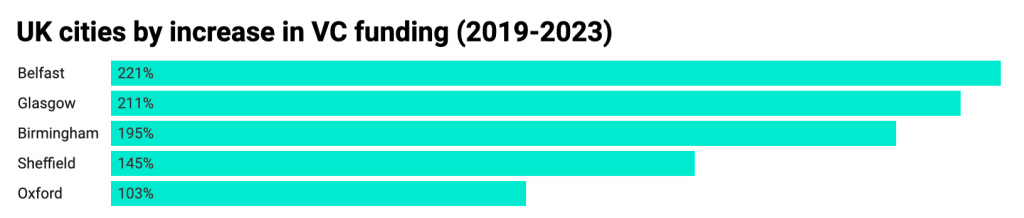

VC investment in Belfast has surged by 221% since 2019, reaching $80 million (£65.3 million), making it the UK’s fastest-growing city for startup investments, as per data from HSBC Innovation Banking and Dealroom.

During the same period, Glasgow saw its VC investment grow by 211% to $109 million, while Birmingham recorded a 195% increase, with investments reaching $94 million in 2023.

Meanwhile, London, which received the highest amount of VC investment in 2023 at $6 billion, has experienced a 48% decline since 2019.

The report highlights other notable performers, such as Sheffield, which increased its VC investment by 145% to $88 million, and Oxford, which grew by 103% to $599 million.

However, Newcastle, Manchester, Bristol, and Liverpool all saw their VC investments decrease by over 60% compared to 2019.

The report indicates that the total VC investment in the UK for the year currently stands at $15 billion, with expectations to reach $18 billion by year-end. This performance is on par with the UK’s 2020 figures but falls significantly below the levels seen in 2021 ($42 billion) and 2022 ($32 billion).

On a global scale, the UK holds the third position in VC investment, trailing behind China and the US. It remains Europe’s most invested startup ecosystem, surpassing France ($8 billion) and Germany ($7 billion).

Despite its leadership in Europe, the UK’s total VC investment has decreased by 14% since 2019, while France has increased its share of investment by 27%.

The report from HSBC Innovation Banking also notes that 37% of the UK’s VC investment comes from the US, with domestic sources contributing 31%.

This data comes at a time when the government is exploring ways to boost British investment, including tapping into pension fund resources.

In July, nine major pension providers in the UK agreed to allocate 5% of their default funds to unlisted equities, amounting to £75 billion in additional capital for startups. This week, 20 venture capital firms signed a commitment to involve pension funds as limited partners in their funds voluntarily.